The way marriage and taxes interact is complicated. There’s something called the “marriage penalty” which affects married couples that both work in good paying jobs. On the other hand, if one of you makes a lot more money than the other, marriage could be a huge tax break for you.

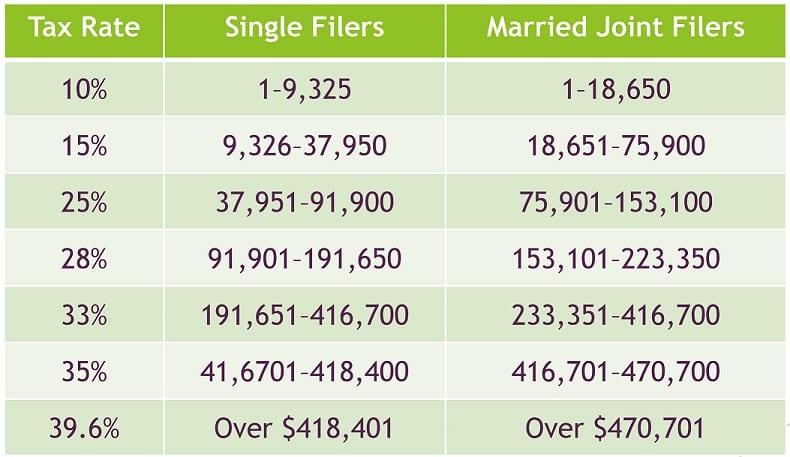

Why is it that way? It’s because the taxes are divided into brackets, but the brackets for married couples aren’t exactly double the brackets for single people. Let’s take a look at the current 2017 tax brackets for single and married people:

The first bracket, for 10% taxes, is exactly double for married couples. So if you both make $9,000 per year of taxable income, if you get married your tax rate doesn’t change.

However, if you both make $90,000 of taxable income per year, you’ll both be in the 25% tax bracket as singles, but you’ll be in the 28% tax bracket when you get married.

On the other hand, if one of you makes $140,000 and the other makes $10,000 (taxable income per year), then that’s great for the person making $140,000 because that pushes all of her income over $91,900 from a 28% to a 25% tax rate.

As you get up into the higher brackets, the differences can get pretty substantial. There’s also the fact that when you make enough money your personal exemptions begin to phase out too.

As you can imagine, this stuff just gets more and more complicated as you add more money, and what you should do is just find a good accountant and talk to them. They’ll look at your particular situation and be able to explain the tax implications for you, and what you can do about it.